Find out about the calculation of income tax 2022-23 for employees. Know the income tax rules for

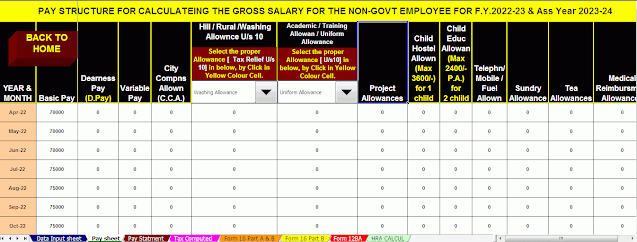

taxing all components of a CTC or gross salary. The remuneration components mainly consist of:

1) Basic salary

The base salary is always fully taxed.

2) Calculation of income tax - HRA

If a taxpayer receives the Rental Allowance (HRA) and pays the rent for a dwelling, then he can apply for an exemption under section 10 [13A] subject to the lesser of the following limitations mentioned, or he can be claimed a minimum of the following amounts as exempt from tax:

(i) Actual amount received

(ii) 50% of the salary if you live in big cities (eg Mumbai,

(iii) Rent exceeding 10% of salary

For the purposes of calculating the exempt HRA amount, Salary will mean the base salary plus the depreciation allowance [if part of the retirement benefits] and the commission earned on the basis of turnover.

NOTE. If a taxpayer who receives the HRA fails to pay the rent, the full amount of the HRA will be taxed.

3) Variable payment

Variable remuneration is part of the remuneration, usually determined by the worker's performance and entirely taxable. Reimbursement (travel expenses, books and newspapers/periodicals, mobile communications, entertainment, etc.)

Pursuant to section 10 (14) of the Information Technology Act, benefits awarded to employees for employment purposes are exempt from tax provided that such expenses are actually incurred by the employees. The employee must have the required invoices and supporting documents as proof to apply for the exemption.

Therefore, the transport allowance is released for the amount of the costs incurred.

Similarly, the refund of books/newspapers and periodicals may be claimed as an exemption under paragraph 10 (14), while the refund of a mobile phone is exempt under rule 3 (7) (ix) of the Computing Rules.

The entertainment allowance, on the other hand, is entirely taxable in the case of private employees. If this representation allowance is granted to employees for the reimbursement of the reception costs of corporate customers, or for commercial purposes, it can be requested as an exception pursuant to paragraph 10, paragraph 14, of the IT law.

4) Leave travel allowance (LTA)

To be eligible for holiday allowance/holiday exemption under Article 10 (5), the taxpayer must meet the following specific conditions:

I. The actual trip is made by the taxpayer

II. Only domestic trips are considered for this exemption.

III. The exemption is granted to the employee alone or together with the family member, the family unit includes the employee's spouse, children, dependent parents, brothers and sisters. However, the exemption does not apply to more than 2 children born after 1 October 1998. This restriction does not apply to subsequent cases of multiple births for the second time after the birth of a child.

IV. The LTA exemption is allowed no more than 2 times, i.e. for 2 trips within 4 calendar years (2022-2025). The amount of the exemption varies depending on the mode of travel. For example, in the case of air travel, lower actual costs or economy class fares will be allowed.

Download Auto-Fill Income Tax Revised Form 16 Part B for the F.Y.2021-22[This Excel Utility can prepare at a time 50 employees Form 16 Part B]

5) Bonus

The bonus is fully taxable

6) Calculation of income tax - Tips

Any tips received while on the job are fully tax deductible. However, retirement benefits will be subject to taxation depending on whether the employer is subject to the Remuneration Act or not.

If the employer is subject to the pay law, the lesser of the following are exempt from the rules u / s 10 (10) of the IT law:

I. Actual amount received

II. Rupees 20 00 000

III. 15-day salary based on the last salary received for each year of service completed, or part thereof, exceeding 6 months (i.e. 15/26 * pm salary * number of years of service completed)

For the purposes of the above calculations, salary means the basic salary in the afternoon. plus off-road allowance.

If the employer is not subject to the Remuneration Act, the minor of the following is exempted

I. Actual amount received

II. Rupees 20 00 000

III. Half monthly salary for each year of work. (ie ½ * Average salary per day * Number of years after the end of service) Any part of a year is not taken into account in the calculation of full years.

NOTE. For the purposes of the above calculation, the average wage in the afternoon. it will mean the average base salary for the last 10 months plus the off-road allowance [if it is part of retirement benefits] for the last 10 months and the average commission earned based on the turnover of the last 10 months.

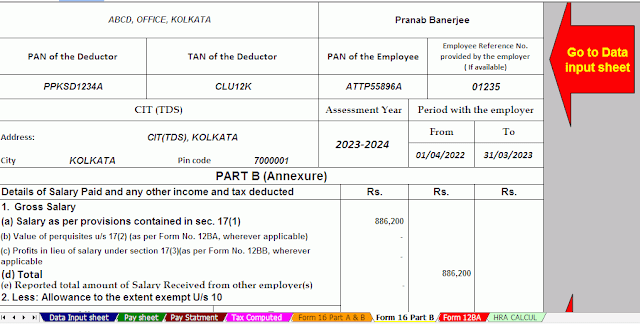

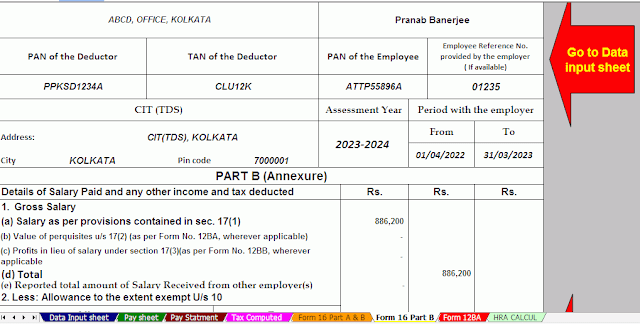

Feature of this Excel Utility:-

1) This Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This Excel Utility has the all amended Income Tax Section as per Budget 2021

3) Automated Income Tax Form 12 BA

4) Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5) Individual Salary Structure as per the Non-Govt(Private) Concern’s Salary Pattern

6) Individual Salary Sheet

7) Individual Tax Computed Sheet

8) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2021-22

9) Automated Income Tax Revised Form 16 Part B for the F.Y.2021-22

10) Automatic Convert the amount into the in-words without any Excel Formula

0 Comments