Section 80 U - Disability Tax Deduction | Check eligibility, discount amount, how to claim, documents,

and definitions, for the fiscal year 2022-23

The Income Tax Law has defined several qualifying deductions in Chapter VIA. Deductions help reduce tax liability, specific deductions for expenses can be understood as deductions, which the Government of India promotes by providing tax relief on expenses such as those at 80C. etc., while other types of deductions are those granted by the government when certain conditions are met to reduce the tax burden. One of these deductions is provided in Section 80U.

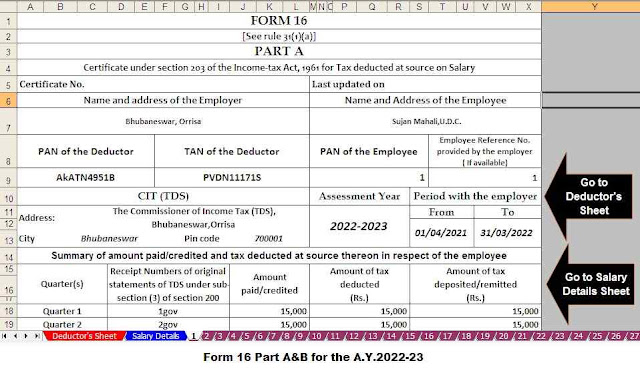

Download Automated Income Tax Form 16 Part A&B for the F.Y.2021-22[This Excel Utility can prepare at a time 50 Employees Form 16 Part A&B]

These deductions are tax deductible in nature and are therefore reduced from your total income. One of these deductions is available under Section 80U. If the taxpayer is a disabled person, he may claim a deduction under this section and may reduce the total tax payment. Let's understand what this section is about and what discounts it offers:

Section 80U Disability Deductions

Section 80U income tax is a disability deduction. This section provides a lump sum discount for a disabled person based on the severity of the disability, regardless of the amount of the expense.

The conditions to claim this discount are:

Taxpayers must be residents.

Have a disability of at least 40%.

The disability must also be certified by recognized medical authorities.

Tax deduction under Section 80U?

Category of discounts allowed

Severely disabled person * One hundred twenty-five thousand rupees ie Rs. 1,25,000/-

Disabled person** Seventy-five thousand rupees, ie Rs. 75000/-

* Severe disability" -

(1) A person with eighty per cent or more of one or more disabilities, as referred to in Subsection (4) of Section 56 of the Persons with Disabilities (Equal Opportunity, Prevention of Rights and Full Participation) as per Act, 1995 (No. 1 of 1996)); either

(2) The severely disabled person referred to in clause (o) of Section 2 of the Law of the National Fund for the Care of Persons with Autism, Cerebral Palsy, Mental Retardation and Multiple Disabilities of 1999 (44 of 1999).

Download Automated Income Tax Form 16 Part B for the F.Y.2021-22[This Excel Utility can prepare at a time 50 Employees Form 16 Part B]

** means "person with a disability": the person mentioned in Clause (t) of Section 2 of the Persons with Disabilities (Equal Opportunities, Protection of Rights and Full Participation) Act 1995 (1 of 1996), or Clause ( j) of Article 2 of the Law of the National Fund for the Care of Persons with Autism, Cerebral Palsy, Mental Retardation and Multiple Disabilities of 1999 (44 of 1999);

80U Eligibility - Who can claim this discount?

Residents who are approved at any time during the fiscal year by medical authority to be disabled person/can claim this discount for themselves only. Residential status determines eligibility for this discount. NRIs are not eligible for this discount.

How much discount is available u/s 80U?

As mentioned above, the amount of the discount depends on the severity of the disability. Thus, taxpayers with less than 80% disability get a deduction of Rs 75,000, and taxpayers with 80% or more severe disability get a deduction of Rs. 1,25,000 lakhs. A deduction is a fixed amount allowed as a deduction from taxable income.

Download Automated Income Tax Form 16 Part B for the F.Y.2021-22[This Excel Utility can prepare at a time 100 Employees Form 16 Part B]

What disabilities does Section 80U cover?

Section 80U is entitled to the following types of disabilities:

Locomotor disability: - This refers to disabilities in the muscles of the joints or bones that lead to severe limitations in the movements of the extremities.

Vision impairment: - People with an impaired visual function that cannot be completely corrected by surgery or standard refractive correction. People with this disability can still use their vision with the help of other devices.

Blindness: - Blindness means the total absence of vision or when the field of vision is restricted to an angle of 20 degrees or worse, or visual acuity is less than 6160 Snellen after corrective lenses.

Leprosy recovery: - People who have been cured of leprosy but still suffer from a disability where they have lost feeling in their feet or hands and partial paralysis of the eyelid and eye. It also includes elderly people or those with severe deformities that prevent them from performing any useful occupation.

Mental retardation: - People who have incomplete or stunted development of mental abilities resulting in abnormal levels of intelligence.

Hearing loss of fewer than 60 decibels

Autism: Autism Spectrum Disorder is associated with brain development that affects the way a person perceives and communicates with others, causing problems in social interaction and communication.

Download Automated Income Tax Form 16 Part A&B for the F.Y.2021-22[This Excel Utility can prepare at a time 100 Employees Form 16 Part A&B]

A taxpayer is considered not severely disabled if they are 40% or more but less than 80% disabled. However, if the taxpayer is 80% or more disabled, it is called severe disability. The discount limit varies depending on the severity of the disability.

How to claim a deduction under Section 80U?

The person claiming the deduction is required to submit a copy of the certificate issued by the medical authority in the prescribed form together with the ITR. In practice, it is not required to attach any document to the ITR, it is advisable to have the document at hand.

Keep in mind that you must present a medical certificate that proves the disability you have suffered. The certificate must be prepared by a recognized medical body in a specific format provided in Form 10-IA and the form can be found on the Income Tax India website

0 Comments