Fixed-term deposits: the best investment or not| Fixed deposit basically means depositing a certain

amount of money for a specific period. You can earn interest on the principal amount over the entire

term cumulatively. Earned interest is added to the principal amount after each specified time period.

Where do you open an FD account?

You can open a time deposit account at a bank where you already have a savings account. Apart from this, there are many banks that allow you to open an FD account even if you don't have a savings account with them after going through the KYC process where you need to provide the relevant documents including proof of identity, proof of address and size photos. passport, among others.

Types of Fixed Deposit Accounts

There are different types of fixed deposits depending on the goals behind them

1) Standard Fixed Deposit: It is the standard FD scheme available in all banks where a certain amount of money is deposited for a specified period and the interest rate is predetermined by the bank. The term of these deposits can vary from 7 days to 10 years and the interest rates are higher than a savings account

2) Fixed Tax Savings Deposits: These types of deposits are useful for tax savings as you can claim tax exemption of up to Rs. 1.5 lakhs per year These FDs have a 5-year lock-in period during which you cannot withdraw the amount and only a single deposit is allowed in this type of fixed deposit.

3) Special Fixed Deposits: These are like standard deposit contracts where funds are invested for specific time periods. The only difference is that if you don't withdraw funds during the specified period, you will earn higher interest than in standard FD contracts.

4) Senior Fixed Deposit: The Senior Fixed Deposit system provides benefits to citizens over 60 years of age. These FD schemes offer an additional interest rate of around 0.50% on top of regular interest rates with flexible periods

5) Flexible Fixed Deposit – These are the FD types linked to your savings account where you can start with an initial deposit of your choice and link it to your savings account.

Fixed deposit interest

Guaranteed Return (FD) Fixed Deposit Accounts are relatively risk-free compared to other forms of investment where investors earn a fixed rate of interest on the amount invested.

Fixed deposits with high-interest rates: These deposit schemes offer a relatively higher interest rate than other forms of traditional investments, such as savings accounts and recurring deposits.

Tax benefits

Time deposits may also provide tax benefits under Section 80c of the Income Tax Act. Investors can avail of up to Rs. 1.5 lakh, as stipulated in Section 80c of the Income Tax Act 1961.

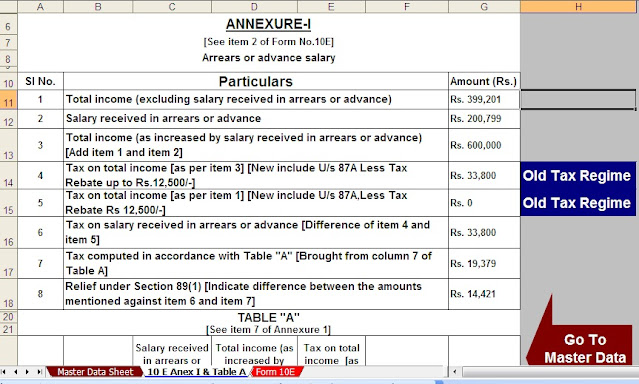

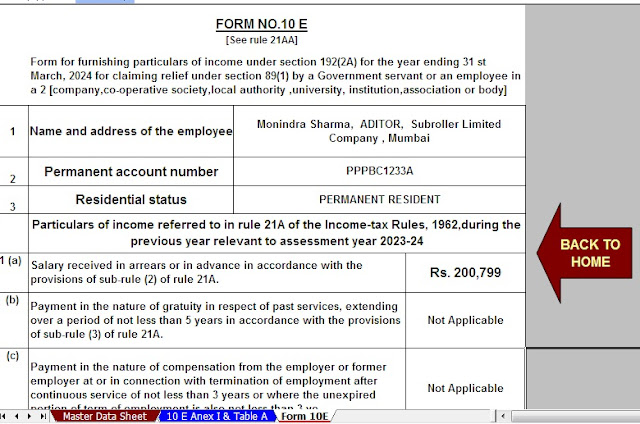

Download Automated Income Tax Arrears Relief Calculator U/s 89(1) along with Form 10E from the Financial the Year 2000-01 to Financial Year 2022-23 (Up-to-date Version)

Share

0 Comments