Income Tax Arrears Relief Calculator U/s 89(1) | Paying taxes is part of adult life. Any citizen, who

earns income above a certain threshold, whether through employment, a self-employed person or a

businessman, will be liable for tax. But the schemes were announced by the Government of India. Not

only does this help save taxes, but these pension plans also encourage saving for retirement

1. What is Section 80CCD?

Section 80CCD of the Income Tax Act, 1961 allows individuals to get tax relief by investing in National Pension System (NPS) and Atal Pension Yojana (APY). The maximum tax deduction a person can claim u/s 80CCD is Rs.2 lakh in a financial year.

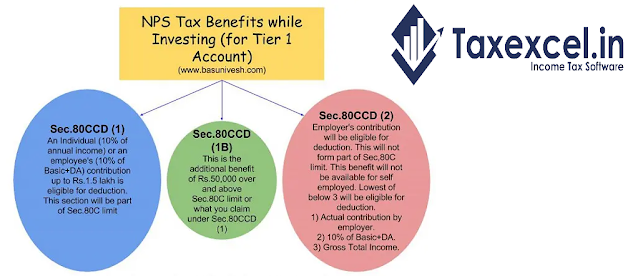

Section 80CCD deductions are divided into two parts: Section 80CCD (1) and Section 80CCD (2). This division serves to distinguish between pension fund contributions paid by the (self-employed) taxpayer and contributions made by employers on behalf of the employee. Currently, an individual can claim a deduction of up to Rs. 1.5 lakh under Section 80CCD (1) and an additional deduction of Rs 50,000 under Section 80CCD(1B) in a financial year.

Section 80CCD (1): .

Under this sub-section of the Income Tax Act, contributions paid to the government, individuals or self-employed persons in the national pension system or Atal Pension Yojana are eligible for tax deductions of up to Rs 1.50 lakh per financial year.

Section 80CCD (1B): .

This sub-section provides for deduction of additional tax of ₹ 50,000 in addition to the amount paid under Section 80CCD (1).

Section 80CCD (2): .

Under this subsection, contributions paid by an employer to an employee’s pension fund are eligible for deductions under Section 80CCD (2). The deduction is limited to 10% of the employee’s base salary plus carrot allowance (DA).

2. Benefits of CCD Section - 80CCD, 80CCC and 80C

Section Description Surface removal

80C Instruments and funds for tax savings Up to Rs 1,50,000 *

80CCC Contributions to annuities and retirement plans

80CCD (1) Employee’s contributions to NPS / Atal Pension Yojana up to 10% of salary + expense allowance

80CCD (2) Employer contributions to NPS / Atal Pension Yojana Up to 10% of basic allowance + + Dearness allowance

80CCD (1B) Submission to NPS and Atal Pension Yojana above the limit of Section 80CCD (1) Up to Rs. 50,000 *.

* Deduction limit of Rs 1,50,000 includes Section 80C, 80CCC and 80CCD (1) deductions. This means you can claim a maximum of ₹ 1,50,000 across all the three parts combined. The Section 80CCD (1B) exemption of up to ₹ 50,000 is above this limit. Therefore, under Section 80C, 80CCC, 80CCD (1) and 80CCD (1B), they can claim a maximum deduction of Rs 2,00,000.

3. Types of Exclusion Section 80CCD in detail

As mentioned above, deductions under Section 80CCD of the Income Tax Act are divided into two sections: Section 80CCD (1) and Section 80CCD (2). with further subdivision under Section 80CCD (1B).

Section 80CCD (1): .

Section 80CCD (1) of the Income Tax Act is an exemption applicable to employed and self-employed workers contributing to the National Pension System and Atal Yojana Pension. Under this section, any person above 18 years of age contributing to an NPS account or Atal Pension Yojana scheme can claim a deduction of up to Rs 1,50,000 per annum. However, this should include the following:

A public or private sector employee cannot claim more than 10% of salary as NPS or APY contributions. Here, salary means base salary plus carrot allowance.

For self-employed workers, the limit is 20% of gross income.

Section 80CCD (1B): .

In the Union Budget 2015, the government introduced a new section of Section 80CCD as an amendment - Section 80CCD (1B). This was done to increase investment in NPS and Atal Pension Yojana schemes. According to Section 80CCD (1B), employed or self-employed individuals can claim an additional deduction of Rs 50,000 while contributing to NPS or Atal Pension Yojana. This deduction is greater than the amount claimable under Section 80CCD (1). However, when you ask for it, make sure there are no duplicate requests, ie. you do not require the same contribution amounts.

0 Comments